What are Stock Appreciation Rights (SARs)?

Stock Appreciation Rights (SARs) are a special type of employee compensation that allows employees to benefit from growth in your company’s stock price over time without having to invest any capital.

In simple terms, your employer grants employees a specific number of SARs that track the value of company shares. You can then “cash in” those rights in the future for the appreciated value of the shares.

It’s an extremely flexible program that provides significant value to both companies and employees when implemented thoughtfully.

Let’s dive into the details of how SARs work and what makes them such an appealing way to structure employee incentives.

The Benefits of Stock Appreciation Rights

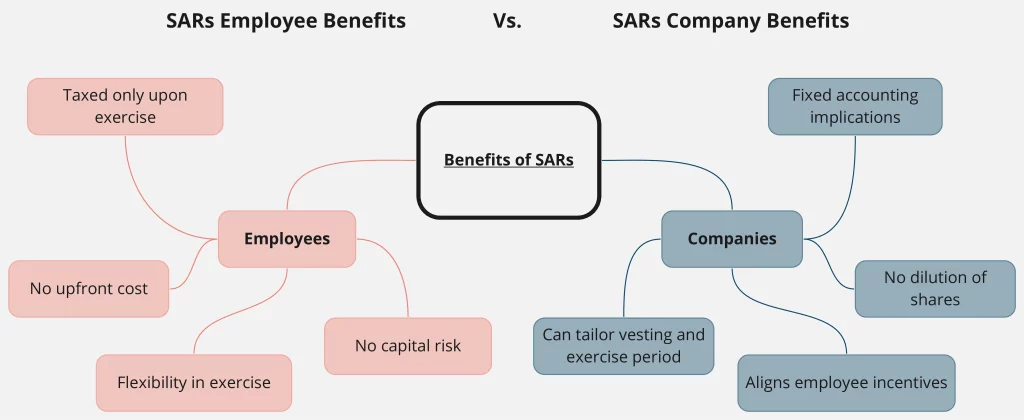

Employees – Benefits of Stock Appreciation Rights

- Receive stock growth benefits without upfront costs – Employees don’t pay anything to receive SARs and can benefit from rising stock values without laying out capital to exercise traditional stock options.

- Upside without downside risk – With options, if the stock declines, you lose your entire investment. But SARs allow you to lock in gains when the stock appreciates without risking capital.

- Tailored vesting conditions – Companies have significant flexibility in determining when SARs will vest and become eligible for exercise. This allows them to create targeted employee incentive programs.

- Tax advantages – Employees pay no taxes when SARs are granted or vest. Taxes are only owed when the rights are exercised.

Companies – Benefits of Stock Appreciation Rights

- No dilution – Unlike stock options, SARs do not dilute ownership or earnings per share when exercised. No new shares are issued.

- Accounting benefits – SARs receive fixed accounting treatment versus potentially variable option accounting.

- Incentive alignment – By tying value creation to share price appreciation, SARs align employee and shareholder incentives.

As you can see, SARs have compelling strengths. Now let’s walk through exactly how they work.

How Do Stock Appreciation Rights Work?

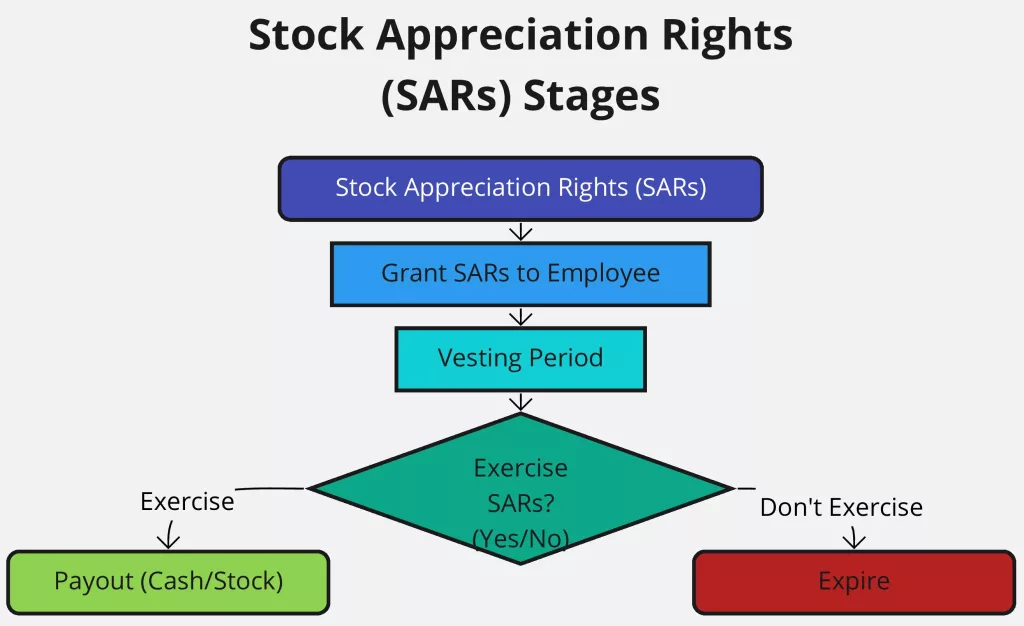

- A company decides to create a SAR program to motivate and reward employees.

- Employees are granted a number of SARs at a set “grant” or “base” price. This starting price is usually the company’s share fair market value at time of grant.

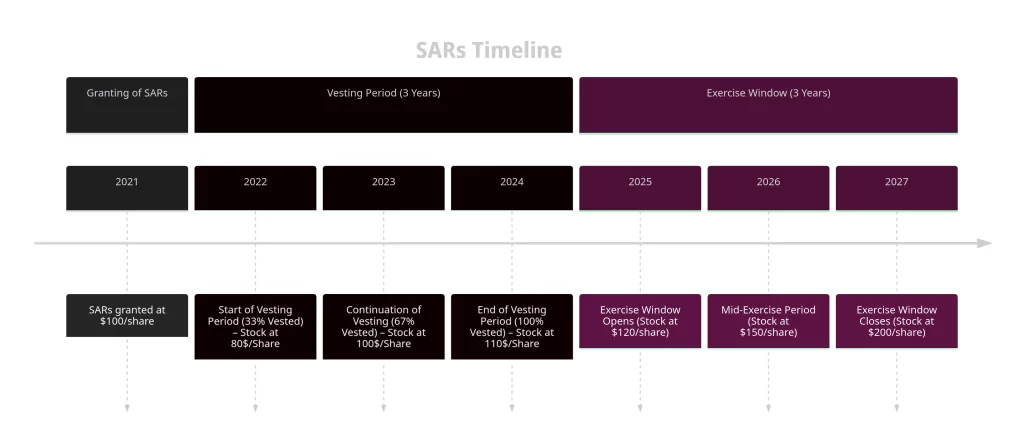

- SARs will then normally have a vesting period where the rights are locked in but cannot be exercised yet. Requirements like tenure or performance thresholds have to be met first.

- Once SARs vest, employees have a window where they can choose to “exercise” their SARs and convert them into value.

- Upon exercise, employees receive a payment equal to the current share price minus the original grant price. Essentially, they are paid out the stock growth their rights are tied to.

- Settlement can take the form of cash, actual stock shares, or a combination depending on plan terms. Most often, SARs will be settled in cash payments to the employee.

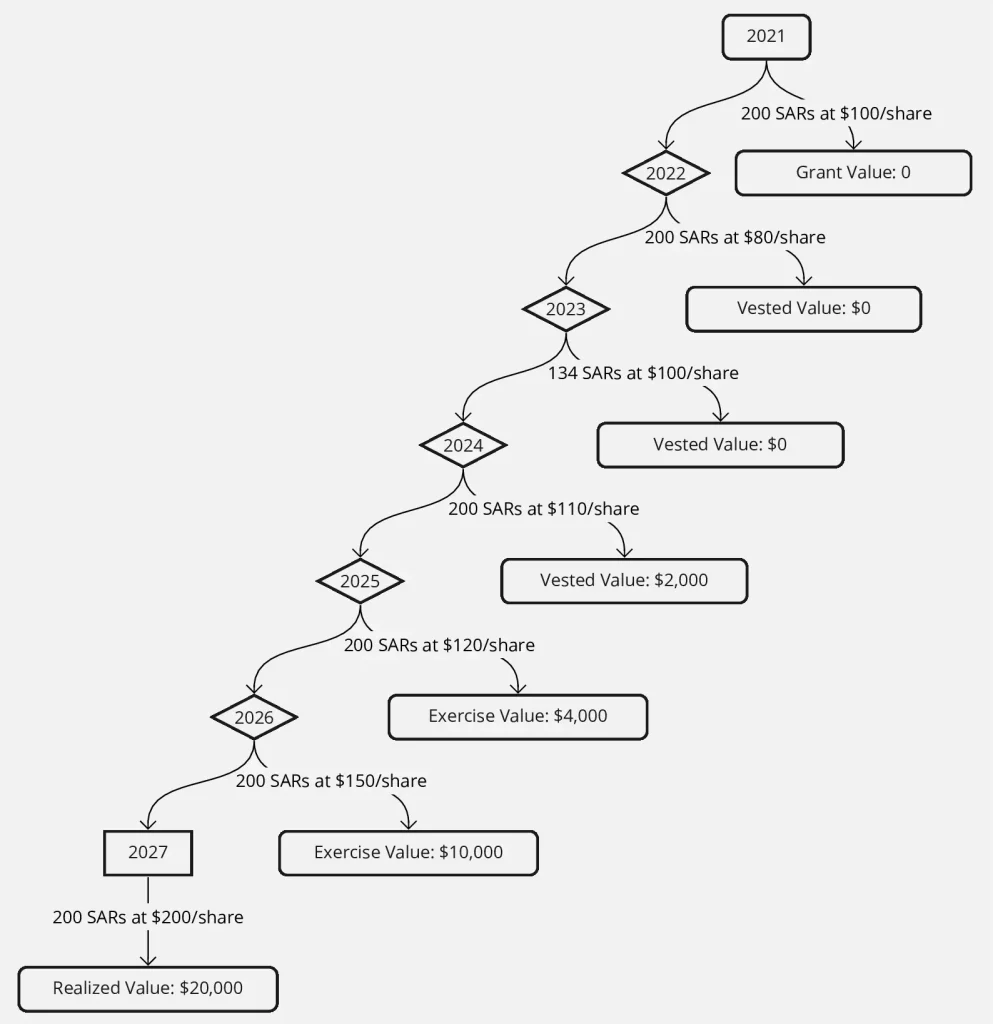

Specifics vary by plan. However, as an example, let’s walk through a hypothetical scenario.

Stock Appreciation Rights Example:

- ABC Corporation grants 1,000 SARs to an employee at $100 per share (1,000 SARs x $100 = $100,000 total grant value)

- A 2-year vesting period applies

- After 2 years, ABC stock has risen to $200 per share

- The employee exercises their 1,000 vested SARs

- This triggers a payout of the appreciated value = Current Price – Grant Price (so $200 – $100 = $100 per SAR)

- For 1,000 SARs, the total payout = 1,000 x $100 = $100,000

The longer the employee holds their SARs before exercise, the more time the stock has to appreciate and the greater potential payout grows. Companies also often place a maximum expiry date by which rights must be exercised.

The flexibility in designing SAR plans allows companies to incentivize behaviors and performance metrics that support business strategy. They are a key alternative to stock options in employee compensation planning.

Types of Stock Appreciation Rights

Standalone SARS

As the name suggests, these rights are granted independently as a pure SAR incentive. They are the most common type used and function as described in the examples already discussed.

Tandem SARS

These rights are granted together with a traditional stock option. This gives employees flexibility in choosing between one or the other when vesting triggers come due:

- The employee can exercise the SAR – This brings cash/stock appreciation without laying out the option exercise price

- Or, the employee can exercise the option – This does require paying the exercise price, but gives them full stock ownership

As you can see, there are two main types of SARs – standalone and tandem. The core difference lies in whether they are granted along with other equity incentives like options or not. This tandem structure provides employees more flexibility in realizing the value created. However, choosing one option negates the other. You cannot exercise both the SAR and option on the same shares simultaneously.

Key Considerations in Stock Appreciation Rights Administration

Grant Size and Schedule

Companies must determine how many SARs to grant employees and what schedules make sense. Standard calendars include:

- Annual grants – Rights are granted at the same time each year

- Milestone grants – Rights are granted when employees reach certain milestones

- Ad hoc grants – More informal ongoing grants as needed

In sizing, companies typically benchmark against a target incentive value appropriate for each employee level rather than just granting a fixed number of rights.

Vesting Requirements

Nearly universally, SARs carry vesting provisions where exercise is restricted until certain tenure or performance requirements are met. Common vesting frameworks include:

- Time-based vesting – Rights vest incrementally over long tenures to support retention

- Performance vesting – Vesting occurs when preset goals are achieved

- Accelerated vesting – Full vesting if certain events like a change in control occur

- Combinations – Mixing time, performance and accelerators

Managing vesting thoughtfully is key to driving behaviors that maximize business performance.

Expiry Windows

While SARs carry vesting rules before exercise is allowed, companies also set expiry rules dictating when the exercise window closes:

- Typically expire 5-10 years from grant date

- Can accelerate expiry 90 days after employee termination

This drives exercise decisions within a specific horizon and also can decrease overhang on financial statements when applicable.

Getting these plan dynamics calibrated correctly is vital to effectively leveraging SARs capabilities.

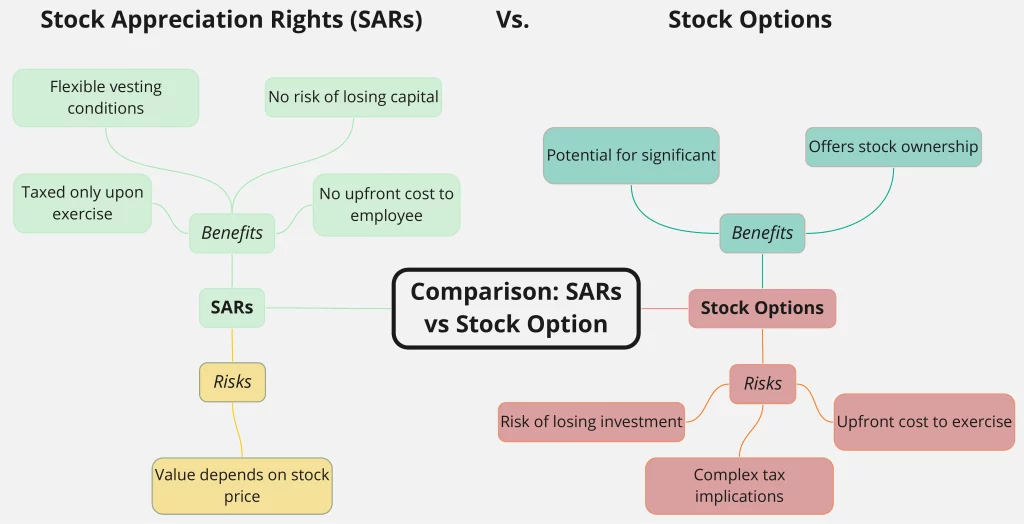

Stock Appreciation Rights Vs. Stock Options

Stock appreciation rights (SARs) and stock options both let you benefit from your company’s financial success. However, there’s an important difference between them. When you use SARs, you don’t have to pay any money for the shares’ original value, but with stock options, you do.

How Can Employees Benefit from Stock Appreciation Rights?

For employee participants, SARs offer a compelling way to share in company growth completely aligned with shareholders:

- SARs require no personal investment or cash outlay from staff – companies handle the entire administration

- By vesting over time and being exercisable for limited windows, SARs reward loyalty and hard work

- Employees receive value through cash payments or company stock which can be a significant financial boon

In a competitive labor market, SARs are a differentiating benefit that helps attract and retain talent.

Employees wanting to understand their existing rights or learn about advocating for a plan should engage with their company’s HR/Compensation teams. There are often opportunities to provide input on how plans are designed.

Being informed of the details outlined above allows employees to maximize the value they receive from SARs.

How Can Companies Benefit from Stock Appreciation Rights?

Employee Motivation

SARs provide significant incentives for employees to perform at high levels and deliver results that build equity value over the long term. These programs can help unlock discretionary efforts that drive strategic success.

Talent Recruiting / Retention

SARs now feature heavily in most competitive compensation packages. Top candidates evaluate equity incentives closely in weighing roles. Effective SAR plans also boost employee satisfaction and engagement over time.

Align Employees as Owners

Well-structured SARs give employees financial exposure to overall company health just as shareholders have. This builds an “owner mentality” that focuses staff efforts on what matters most in value creation.

To be most impactful, companies should carefully tailor their plan specifics to the behaviors most vital for their specific situation and objectives.

Getting the SAR program design right delivers outsized organizational advantages and value.

Show Image – infographic summarizing what SARs are and how they work

Summary of Stock Appreciation Rights

Some of the key points we have covered on stock appreciation rights include:

- SARs Reward Growth – Employees receive compensation equal to the appreciated value of company shares over time without any capital outlay

- Flexible Terms – Companies can structure plans to incentivize behaviors that best fit their strategy

- Tax Advantaged – Employees only have taxable events when SARs are exercised, not at grant

- Tandem Options – SARs can combine with traditional stock options to maximize program flexibility

- Accounting Benefits – SARs give more favorable financial statement treatment than stock options

- Drive Ownership Culture – Well-designed SAR plans align staff with shareholders

SARs are a compelling way for companies to reward employees when stock values rise over time. Calibrating program specifics thoughtfully is key to maximizing SARs strategic and financial benefits.

Employees should educate themselves on the details of SAR plans made available and evaluate periodically whether to exercise vested rights. Companies should consult experts in evaluating whether SARs have a place in their overall compensation framework.

Used strategically, stock appreciation rights create value for both staff and employers over time. Are you taking full advantage of their possibilities?

Frequently Asked Questions

Do SARs convey actual stock ownership?

No. Because SARs are settled in cash or stock appreciation value, they do not grant employees actual company stock shares or the associated voting rights unless delivered specifically upon exercise. They mimic financial exposure to stock movements only.

What happens to SARs if an employee leaves a company?

Typically, SARs will expire 90 days after an employee departs. Some plans may allow longer if termination meets certain criteria like retirement. Any previously vested SARs should be exercised before expiry or rights to that value will be lost.

Do SARs provide dividends like real shares?

Generally, no. SARs mirror the increase or decrease in company share prices over time but do not qualify for receiving dividends issued to actual shareholders. A few more complex plans pay “dividend equivalent” rights but this is less common.

What are the tax obligations around SARs?

One key benefit of SARs is tax treatment. Employees incur NO tax liabilities at the time of grant or vesting – taxable events only occur at exercise. When SARs are exercised, granted appreciation is taxed as ordinary income. Some companies provide shares “net of withholding taxes”, keeping a portion to remit taxes on the employee’s behalf.

Understanding tax impacts is an important part of evaluating exercise timing scenarios. Consult a tax adviser if needed.

Hopefully, these FAQs provide helpful context on common SARs-related questions. Feel free to reach out for any other clarification required.

For more information, check out our video on Stock Appreciation Rights:

Summary of Stock Appreciation Rights

We have covered a lot of ground on the features and use cases for stock appreciation rights plans. Some key conclusions to close with:

- SARs are an important equity compensation instrument that offers advantages to both companies and employees

- Program specifics can be calibrated to drive strategic behaviors by rewarding growth in stock value

- Employees should educate themselves on available SAR plans and exercise dynamics to maximize value

- For companies, SARs support talent recruitment, culture, and goal alignment when structured thoughtfully

Revisiting plan specifics periodically allows both groups to ensure these incentive programs are delivering on their significant potential.

With a grasp now on the SARs landscape, do you see opportunities in your situation to deploy or enhance these plans to drive performance? What questions do you still have? Happy to chat about it with you.